Basis points are a crucial concept in the financial world that every investor should understand. Whether you are involved in banking, investment, or financial analysis, the term 'basis points' plays a significant role in how interest rates and financial metrics are reported and understood. This article will delve into what basis points are, how they are calculated, and their implications in real-world financial scenarios. By the end of this guide, you will have a solid understanding of basis points and how they affect your investments.

In the financial industry, precision is paramount, and basis points offer a clear way to convey changes in rates without ambiguity. A basis point is one-hundredth of a percentage point, often abbreviated as "bps." For example, a change from 2.00% to 2.25% represents a shift of 25 basis points. Understanding this concept is critical for making informed decisions in the investment landscape.

As we explore this topic further, we will cover various aspects including the calculation of basis points, their usage in different financial contexts, and their importance in investment strategies. This comprehensive guide aims to equip you with the knowledge necessary to navigate the complex financial world effectively.

Table of Contents

- What are Basis Points?

- Importance of Basis Points in Finance

- Calculating Basis Points

- Usage of Basis Points in Financial Markets

- Impact of Basis Points on Investments

- Basis Points vs. Percentage Points

- Real-World Examples of Basis Points

- Conclusion

What are Basis Points?

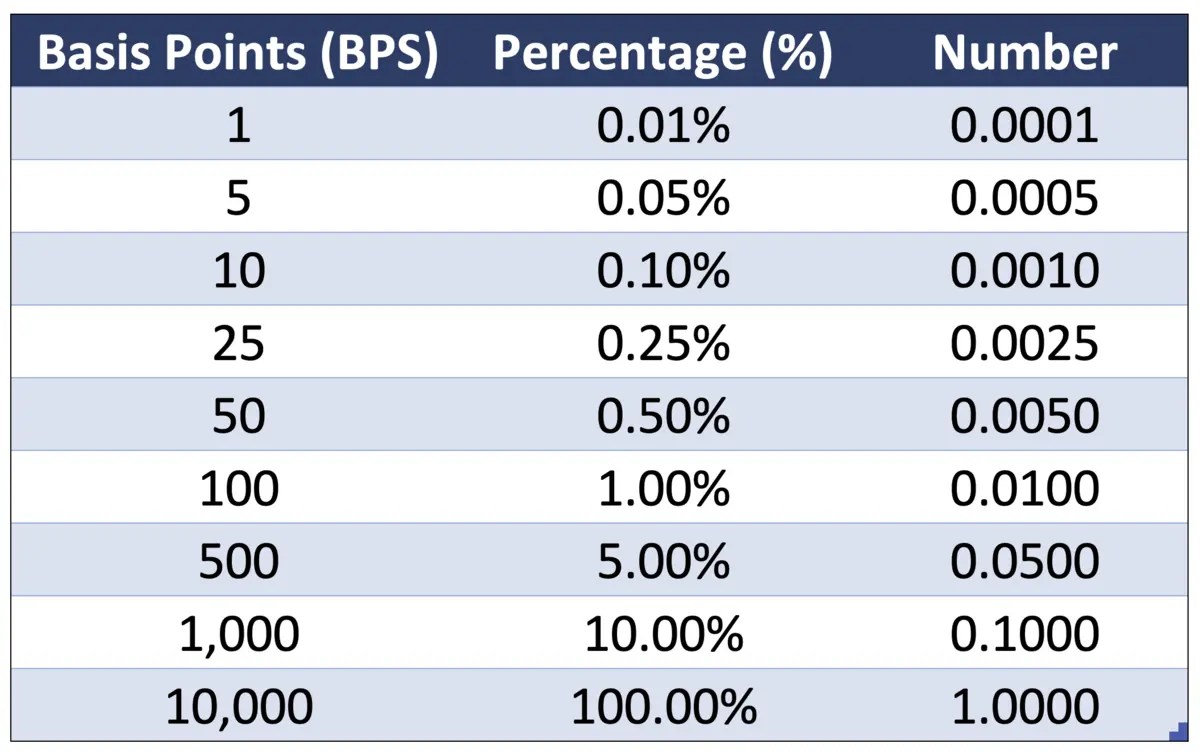

A basis point is a unit of measurement used in finance to describe the percentage change in the value or rate of a financial instrument. It is defined as one-hundredth of a percentage point, represented numerically as 0.01%. This precise measurement is particularly useful in scenarios where small changes can have significant implications.

Definition and Explanation

To clarify, if an interest rate increases from 3.00% to 3.50%, this represents a change of 50 basis points. This clear differentiation helps avoid confusion, especially when discussing interest rates, bond yields, or other financial metrics that can fluctuate.

Contextual Usage

Basis points are commonly used in the following contexts:

- Interest rate changes

- Bond yields

- Investment performance metrics

- Fees and expenses in financial services

Importance of Basis Points in Finance

Basis points are vital in the financial sector for several reasons:

- Precision: They provide a more accurate representation of small changes in interest rates or yields.

- Clarity: They help avoid misinterpretation when discussing percentage changes.

- Standardization: Basis points offer a common language for financial professionals.

Calculating Basis Points

Calculating basis points is straightforward. The formula to convert percentage changes into basis points is:

Basis Points = (New Rate - Old Rate) x 100

For example, if the interest rate increases from 2.5% to 3.0%, the calculation would be:

Basis Points = (3.0 - 2.5) x 100 = 50 basis points.

Usage of Basis Points in Financial Markets

In financial markets, basis points play an essential role in various instruments:

- Bonds: Changes in yield are often expressed in basis points.

- Loans: Interest rates for loans can vary by basis points, affecting the overall cost.

- Investments: Performance differences between funds are often measured in basis points.

Impact of Basis Points on Investments

The impact of basis points on investments can be significant. For instance, a seemingly small change in interest rates can lead to substantial shifts in investment returns:

- A 25 basis point increase in interest rates can lead to higher borrowing costs.

- Bond prices typically fall as yields rise, impacting investors' portfolios.

Basis Points vs. Percentage Points

It's crucial to distinguish between basis points and percentage points:

- Basis Points: Refers to a change in percentage (1 basis point = 0.01%).

- Percentage Points: Refers to the difference in percentages (e.g., an increase from 2% to 3% is a 1 percentage point increase).

Real-World Examples of Basis Points

Here are some real-world scenarios illustrating the use of basis points:

- In 2020, the Federal Reserve lowered interest rates by 150 basis points in response to the economic impact of the COVID-19 pandemic.

- When evaluating the performance of mutual funds, investors often look at the annual return difference in basis points.

Conclusion

In summary, understanding basis points is essential for anyone involved in finance or investing. They provide clarity and precision that enhances financial communication. As you navigate the world of investments, keeping track of basis points can help you make more informed decisions and understand the implications of interest rate changes.

We encourage you to leave your thoughts in the comments below, share this article with fellow investors, and explore more of our financial resources.

Thank you for reading, and we hope to see you back for more insightful articles on finance and investment strategies!

You Might Also Like

Understanding Tap Plastics: A Comprehensive Guide To Products And ServicesAga's Restaurant & Catering: A Culinary Journey You Won't Forget

Texas Longhorns Score: A Comprehensive Guide To Their Performance

Understanding The Iran-Iraq War: Causes, Consequences, And Insights

Understanding The Controversy Behind The 2 Girls 1 Cup Video

Article Recommendations

- Jonah Hill Sarah Brady Text Messages Full Transcript 1812193

- Tiffany Gomas Not Real Tiktok Video Ultra Right Beer Photo 1891657

- Rainbow Bridge Closure What We Know 1846195

- Little Rascals Netflix Where Are They Now 2021 1582862

- Donald Trump Calls Jd Vance Town Hall Michigan 1974861

- Sweatpea Owner Speaks About Dog Honored During 2024 Puppy Bowl 1869279

- Mel Gibson Anti Semitism Racism Accusations 1512808

- New Jersey Map Population Shifting Crowded 1975080

- Joe Alwyn Posts Brooding Photo After Taylor Swift Cozies Travis Kelce 1950189

- What Pamela Anderson Has Said About Sex Tape Tommy Lee Pamela Love Story Netflix 1776828